An In-depth Introduction of Secured Credit Card Singapore Options for Boosted Credit Control

An In-depth Introduction of Secured Credit Card Singapore Options for Boosted Credit Control

Blog Article

Unveiling the Opportunity: Can People Released From Insolvency Acquire Credit Report Cards?

Comprehending the Effect of Insolvency

Personal bankruptcy can have a profound influence on one's credit history score, making it challenging to accessibility credit report or fundings in the future. This financial tarnish can linger on credit reports for several years, impacting the person's capability to safeguard positive rate of interest rates or economic chances.

Additionally, bankruptcy can restrict employment opportunities, as some employers perform credit rating checks as component of the employing process. This can present a barrier to people seeking brand-new work prospects or profession improvements. On the whole, the impact of bankruptcy extends beyond financial constraints, affecting various facets of an individual's life.

Elements Influencing Charge Card Authorization

Obtaining a credit score card post-bankruptcy rests upon different crucial aspects that considerably influence the authorization process. One critical aspect is the candidate's credit rating. Following personal bankruptcy, people usually have a reduced credit report rating because of the negative effect of the personal bankruptcy filing. Charge card companies usually seek a credit report score that shows the candidate's ability to handle credit responsibly. Another crucial consideration is the applicant's earnings. A stable income guarantees charge card companies of the individual's capability to make prompt payments. Furthermore, the length of time since the insolvency discharge plays a crucial duty. The longer the period post-discharge, the extra desirable the opportunities of authorization, as it suggests financial stability and liable debt actions post-bankruptcy. Additionally, the kind of charge card being made an application for and the company's particular needs can additionally impact authorization. By meticulously taking into consideration these aspects and taking actions to rebuild debt post-bankruptcy, people can boost their potential customers of getting a charge card and working in the direction of economic recovery.

Steps to Restore Credit Rating After Bankruptcy

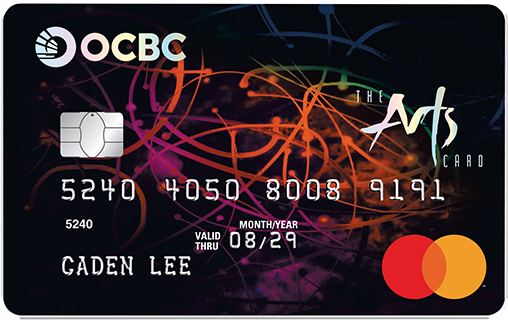

Restoring credit scores after bankruptcy calls for a tactical technique concentrated on economic self-control and constant financial debt management. One effective approach is to obtain a secured credit report card, where you transfer a particular amount as collateral to develop a credit limitation. In addition, think about ending up being a licensed customer on a family member's debt card or discovering credit-builder fundings to more improve your debt rating.

Protected Vs. Unsecured Credit Scores Cards

Complying with personal bankruptcy, individuals typically think about the selection between secured and unprotected credit score cards as they intend to reconstruct their creditworthiness and financial stability. Protected credit score cards need a money down payment that serves as collateral, normally equivalent to the credit report restriction approved. Eventually, the option in between secured and unsafe credit report cards need to straighten with the individual's financial objectives anchor and capacity to take care of debt responsibly.

Resources for People Looking For Credit Score Reconstructing

For individuals aiming to boost their credit reliability post-bankruptcy, checking out readily available sources is important to efficiently browsing the credit rating rebuilding process. secured credit card singapore. One beneficial resource for people looking for credit report rebuilding is credit scores counseling firms. These organizations supply monetary education, budgeting image source aid, and individualized debt renovation strategies. By functioning with a credit history therapist, people can get insights into their credit records, find out strategies to improve their credit history, and get guidance on managing their financial resources properly.

Another useful resource is credit report surveillance services. These solutions allow people to keep a close eye on their credit history reports, track any inaccuracies or adjustments, and detect possible indicators of identification burglary. By checking their credit frequently, people can proactively deal with any issues that might arise and guarantee that their credit score info depends on day and exact.

In addition, online devices and resources such as credit history simulators, budgeting apps, and monetary literacy internet sites can provide people with valuable info and tools to aid them in their credit rating rebuilding trip. secured credit card singapore. By leveraging these sources effectively, individuals discharged from insolvency can take meaningful steps towards boosting their credit scores health and wellness and protecting a better monetary future

Verdict

Finally, people released from bankruptcy may have the chance to acquire charge card by taking steps to reconstruct their debt. Variables such as credit score debt-to-income, history, and revenue proportion play a substantial role in charge card approval. By understanding the impact of bankruptcy, choosing between secured and unprotected credit cards, and utilizing sources for credit rebuilding, people can enhance their credit reliability and possibly get accessibility to bank card.

By working with a debt therapist, people can obtain understandings right into their credit rating records, find out methods to enhance their credit ratings, and get assistance on handling their financial resources efficiently. - secured credit card singapore

Report this page